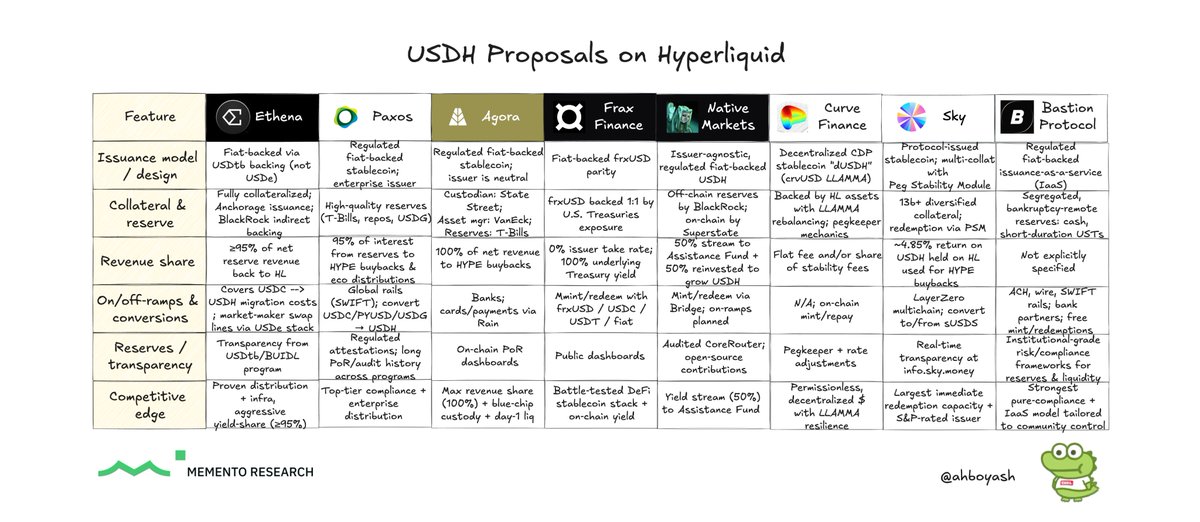

The Battle for $7.5B USDH ⚔️ Hyperliquid has opened an RFP to decide which third-party issuer will power its stablecoin, $USDH. The move is aimed at cutting reliance on USDC and Coinbase while keeping reserve yields and liquidity incentives inside the Hyperliquid ecosystem. Eight contenders are in the ring: > Ethena: Fiat-backed via USDtb, ≥95% of reserve yield routed back to HL, migration paths from USDC. > Paxos: Enterprise-grade rails, regulated audits, 95% of interest to HYPE buybacks and ecosystem. > Agora: Custody with State Street, managed by VanEck, 100% net revenue to HL, $10m+ day-one liquidity. > Frax Finance: Pegged to frxUSD, 0% issuer take rate, on-chain T-bill yield, fiat on/off-ramps. > Native Markets: Issuer-agnostic via Bridge, 50% to Assistance Fund and 50% to USDH growth. > Curve Finance: Decentralized CDP twin (dUSDH), pegged with LLAMMA mechanics. > Sky: Multi-collateral stablecoin with Peg Stability Module, instant 2.2B USDC redemption, yield to HYPE...

Show original

7.1K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.